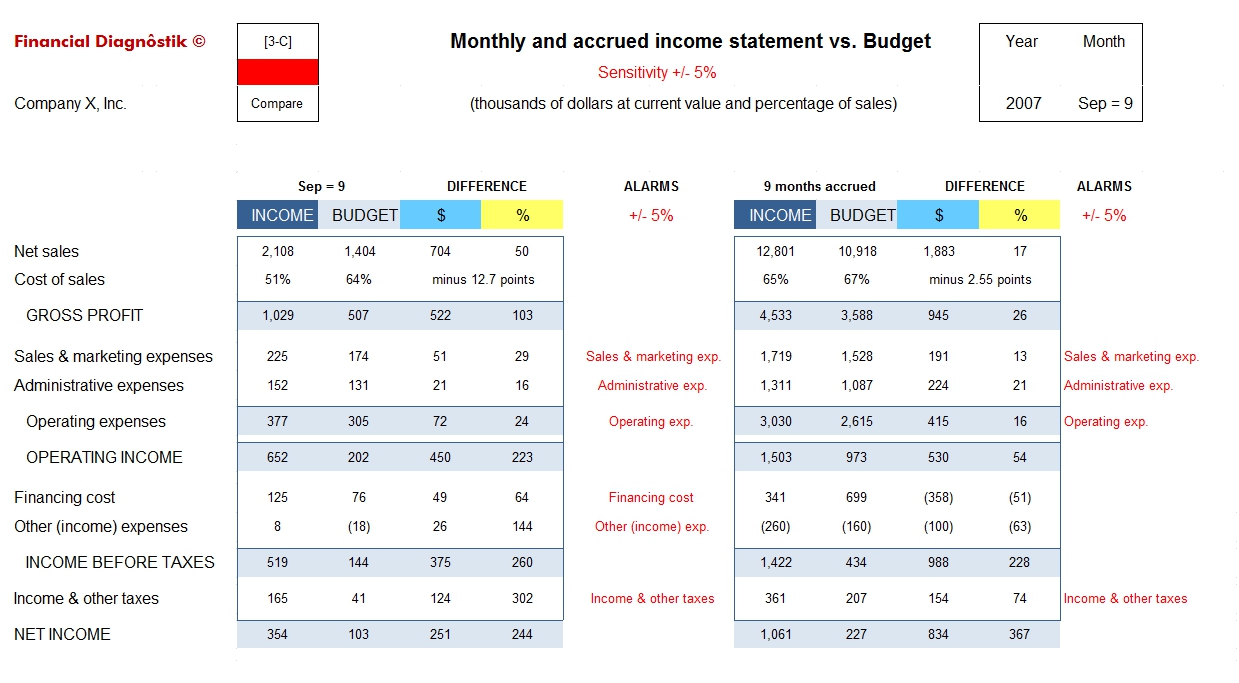

[3-C] Comparative of month and accrued vs. Budget

Currency unit and % percentage of sales.

% Programmable sensitivity

Here we display an example of how the company would look after 9 months operating. In this report we can clearly analyze the behaviour of the month vs. the budget and their differences (in current value and percentages). Similarly, we can see the development of the business "accrued to the current month", with its percentages and differences.

To the right of each table, there are indicated in words the ALARMS of the rows that are out of the budget, taking in account the percentage of sensitivity previously chosen (in this case 5%); in other words, it is not required to scan the numbers to notice the problems.

In the row of Cost of sales, we prefer to compare the costs in percentage and call it 'points'; meaning that the arithmetic difference between the percentage of budgeted Cost and the percentage of real Cost is the one shown.